Costs of Ownership: Dues and fees can add up, even before you add golf membership

I thought today about a friend of mine who lives in a nice Florida golf community –- on the east coast of the state -– and pays nearly $30,000 in carrying costs annually, even after resigning his golf club membership. His home is valued a little north of $400,000. I thought his carrying costs were an anomaly, but after doing a little research for a customer from the United Kingdom who is considering purchasing a condo in Florida, I’ve spent the day contemplating the costs of ownership.

Here are the details on one listing I reviewed for my UK customer:

Community: Waterlefe in Bradenton, FL

Unit: 2 BR, 2 BA, 1,300 square feet

Semi-private golf and all other standard amenities

The Manatee River runs along edge of golf course.

Price: $182,500

Now that certainly seems like a fair, maybe even a bargain, price for a unit in a modern, well-tended golf community. Close inspection of the listing may reveal why the price appears so reasonable. First, there are the taxes, set at $2,077 annually. But this being Florida -– a zero-income-tax state where they have to pay for things somehow -- there is an annual charge of $2,408 for CDD, which stands for Community Development District, essentially a local tax to run the local community. The CDD is in lieu of an incorporated town. In essence, the tax on the $182,500 condo is a healthy $4,485 annually. But of course, any owner of a home in a planned development is on the hook for homeowner association dues; in the case of Waterlefe, HOA dues are $483 per quarter, or $1,932 per year.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Don’t play your retirement golf in a cow pasture

I love those Direct TV ads that turn a guy depressed at the size of his cable bill into a hang glider who, through a series of causes and effects, gets his poor old father punched in the gut over a can of soup. It gave me an idea for a script for Home On The Course’s first advertisement. Unfortunately, we don’t have the budget to put it on cable television or Direct TV so you will have to imagine it.

[Husband and wife sitting at a kitchen table]

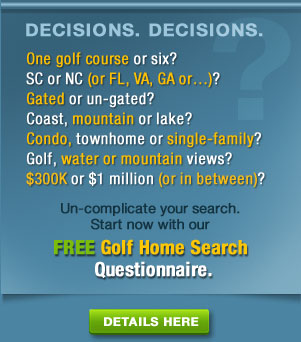

Wife: Honey, I went to that Golf Community Reviews.com web site. If we fill out the Golf Home Questionnaire, the editor of the site says he’ll find golf communities that match our requirements.

Husband: But I don’t like the idea of buying a house with the help of a guy we found on the Internet. We can do the research and find a golf home on our own.

[Authoritative Voiceover of Narrator]

When you do your own research to find a golf community, it takes you three years to decide if you want to live in the mountains, near the ocean or on a lake.

When you take three years to decide where you want to live, it takes you another three years to visit all the places you think you could live.

When you take six years to find a place that might suit you, prices have risen 45% and you can’t afford the home you once could. Not even close.

When you can’t afford the home you once could, you wind up living in a shack and playing golf at a local cow pasture with no rough except on the greens.

Don’t wind up living in a shack and playing golf at a local cow pasture with rough greens. Click here for our Golf Home Questionnaire, and we will match your requirements to the many find golf

communities that you can afford…now.

Interest rates, shminterest rates: Can a rise really trash the market?

I get a kick out of some real estate experts’ comments when the topic of potential interest rate rises comes up. “That will kill the real estate rally,” they shout. “Cash investors buying up inventory in order to generate rental income will lose interest (no pun intended),” some say. “New home buyers will rent instead,” others add.

Balderdash. What will kill the real estate rally is a bad economy and a loss of consumer (buyer) confidence in the immediate future. Here’s my case for ignoring a slight uptick in interest rates (by “slight,” say 2 percentage points or less):

- Prices in many markets are still not nearly back to 2007 levels. And most of us aren’t planning to move to Miami, Las Vegas, Phoenix or any of the other markets that were ravaged after 2007 and where the experts tend to focus their remarks about “too far and too fast”; needless to say, Las Vegas is not Chapel Hill, NC, or Greenville, SC, or vice versa. And baby boomers looking to get on with their lives are not, generally, the real estate investors or first-time buyers the experts are focused on.

- Counter-intuitively, a slight climb in interest rates often results in an increase in home prices as it buttresses the notion of renewed economic growth. And, potential buyers tend to rush into the market before rates rise even higher, pushing up demand (and prices). The naysayers may think we are on the back end of this phenomenon of demand, but it may have some months, or even years to go if rates do not rise too quickly.

- Home listing agents are well aware that interest rates may be on the minds of their sellers, and they turn that to an advantage when it comes to pricing a home for quick sale. “You know,” they might tell the seller, “that interest rates are up and that could slow down traffic to your house if we don’t price it right.” In short, buyers may benefit by a lower price on a home they want if interest rates are up (or perceived to be so). And a lower house price can soften the effects of a slightly higher interest rate.

- Would a couple really give up their dream of a home for $120 per month? That is the difference in monthly payment of a $200,000 loan over 30 years at a 5% mortgage rate vs a 6% mortgage rate. If rates should rise to 7%, for example, the rise in monthly payment would be $257. (Keep in mind, Uncle Sam basically subsidizes around a third of the increase, depending on the borrower’s tax bracket and how much of the monthly payment is interest rather than principal.) In many households, that extra payment could certainly be a stretch while one or both wage earners wait for a salary increase to cover the differences. But we often look at the percentage increases and think they imply a much higher increase in dollar outlays than the real numbers indicate.

- The “experts” ignore one important fact of home ownership vs renting, beside the economic advantages through tax deductions and associated incentives –- a sense of belonging. Owners, unlike renters, feel a vested interest in the health of the community; we may hate paying local taxes, but doing so makes us feel as if we have a voice in town operations. And if we decide to show up at a town council meeting to complain, there is no more-credible introduction than “My name is...and I own a home at…”

- Buying a home is good for the ego; it can make you feel like a big-shot employer with a payroll that includes a mortgage loan officer, engineering inspector, lawyers (for the closing), the title insurance actuarial and, of course, the real estate agents working in your behalf and the seller’s. On behalf of a grateful real estate industry, I thank you in advance for the purchase of your dream golf home. If I can help you make your dream, and the dreams of local closing attorneys in the southeastern U.S. come true, please contact me. Or, better yet, fill out our Golf Home Questionnaire, and I will respond to you with suggestions of which golf communities best match your requirements.

The North bleeds baby boomers: Guess where they are all headed?

A map in Thursday’s Wall Street Journal depicting “senior migration” provides a stark reminder that baby boomers are moving south, predicting rises in real estate prices below the Mason-Dixon line and softening of real estate values in areas like New England and the upper Midwest. Those on the cusp of retirement and thinking about relocation to a warmer climate will find they have plenty of company. And if supply of homes can’t keep up with demand, there could be the potential for boomers bidding for the choicest properties in the most popular areas.

Yes, I know, I am in the business of helping baby boomers (and others) find properties for vacation and retirement in southern golf communities; therefore, I can be accused of having an interest in encouraging folks to move sooner rather than later. Guilty, as charged. But the numbers don’t lie, and according to the WSJ’s map, the net migration into the Carolinas each year between 2009 and 2012 has been more than 10,000, and into Florida more than 50,000. (And you thought Florida was dead.) All other southeastern states except for Virginia saw net in-flows of seniors (aged 55 and older) whereas Delaware, Vermont and New Hampshire saw tiny increases (about 500 annually) of the same population.

Do golf community condos offer investment potential?

In 2009, after the housing recession was in full swing, I traveled around the Orlando area with a real estate agent who specialized in significantly undervalued properties, typically those that had been foreclosed on and were now bank-owned. Some of the properties were in awful shape, with interior walls punched in by angry former owners as they left their home for the final time, and some outside mechanicals, like air conditioner units, lifted off their foundations and taken away. Unsurprisingly, the selling prices of these properties were way under their inherent value, and with something like $8,000 to $10,000 in rehab costs, the properties could be put back in

For those without an uncle (or son) in the business of rehabbing distressed houses, there are similar opportunities today for the adventurous. Some golf community property owners pressed for cash are still listing their condos and town homes at recession-era prices. Last week I was conducting research for a customer looking to move to a $200,000 golf community condo within eight hours of New York City, and I was perusing listings in the Kingsmill Resort in Williamsburg, VA. I came across one listing for a 2 BR, 2 BA unit posted at $199,500. The fine print indicated it was a foreclosure, but the general description indicated an average annual rental income on the property of $41,000, for an impressive annual return of about 20%. ($40,000 divided by $200,000) Something smelled fishy –- I thought I knew what it was -– and I contacted a Williamsburg Realtor I know and he confirmed my suspicions about management fees the Kingsmill real estate office charges for renting out the condo.

“They get 50%,” he said. “It’s highway robbery, but they are the only game in town.”

Owning vs renting a golf community home

The own vs. rent conundrum my wife and I confronted early in our marriage (33 years this coming year) is well behind us, what with both a primary home and a vacation home in our real estate portfolio today. But with a daughter about to be a university graduate with stable job prospects, we are into the discussion all over again. She and her boyfriend have been blunt: “We don’t want to waste money on renting.”

My first instinct is to mutter, “Youth is wasted on the young” and then make the case for patience, establishing a career first, maybe investing excess earnings in the stock market or some other money-grower. And yet, when I think about it, I remember the charge I got when I figured out that buying my first home and paying monthly principal, interest and taxes would save me $100 a month compared with my “wasted” rent at the time. (Note: The home was a brand new cedar and stone contemporary on a beautiful, sloping treed lot north of Atlanta that I bought for $43,000. It was 1978. If I had stayed in that home during the full duration of my 30-year mortgage, it would be worth more than $500,000 today.)

Cautionary Tale: How belief in developer hype ruined a retirement

New developers at Bella Collina, the central Florida deluxe golf community originally developed by Bobby Ginn, recently won a local court judgment that clears the way for them to restart development there. One couple has purchased a lakefront lot for $87,000 that originally sold for $1.7 million. We only hope the original owners were able to afford that staggering loss.

Other property owners who were seduced by the Ginn story of impending riches could not afford the losses. We were especially moved by the story of one of our readers, a police officer in Minnesota who retires next May and whose life was turned upside down by an investment in a Ginn property at Cobblestone Park, just north of Columbia, SC. After paying $265,000 for a lot at Cobblestone in 2005, he and his wife watched the value of their investment virtually disappear in the wake of the Ginn empire’s financial troubles, followed shortly after by the 2008 crash.

The practice facilities at Cobblestone Park are especially good, given that the top-flight University of South Carolina gamecocks golf teams ofter practice there.

“We thought we were in for a sure thing, investment-wise,” says Ray, not his real name. “We expected great returns, money that we would eventually use to help our boys through college.”

“Now, our boys are stuck with significant student loan debt to follow them for decades. We are now eight years into making monthly mortgage payments [on the lot in Cobblestone], membership dues, HOA fees, and taxes…”

The family lost more than $240,000 on paper. Recently, D.R. Horton purchased most of the remaining developer properties at Cobblestone Park and made Ray a lowball offer for the lot, which he was willing to accept just to get out from under the carrying charges. But then Horton withdrew the offer shortly after for reasons only a bureaucrat could understand.

After Seven Great Years, We’ve Changed the Furniture at Golf Community Reviews

I am proud to say we have reached the seven-year mark at this blog site. Call it the seven-year itch, or call it keeping up with the times, but we are changing the furniture here at Golf Community Reviews. Here’s a quick overview.

A Fresh, New Design

We’ve added a bit more color and contrast to make it quicker and easier to find those sections of our web site of most interest to you. For those who have specific search criteria, we are making it a little easier to find items of interest and refine the list if needed. (Since we have posted nearly 2,000 articles here, better internal search has become a necessity.) We move furniture around our house to promote a new way of looking at things, which often leads to more effective communication. We’ve tried to do the same at Golf Community Reviews.

Going Mobile

I don’t know how great golf course architects do what they do, and neither do I understand how web site design software works, but the new Golf Community Reviews has been rebuilt using something called “responsive design.” This means that if you visit our site on one of your mobile devices (iPad, iPod, etc.), navigation will be much easier than in the past. The layout of Golf Community Reviews on your mobile device will accommodate the size and configuration of your iPad or Android phone or whatever you are using.

Quick Access to More Articles

We will post only the first few paragraphs of an article on the home page, with the option for you to click the “Read More” button if we have captured your attention. That means you won’t have to scroll through long articles to get to others that may be of greater interest to you. And in our newsletter “archives,” we now indicate the headline of the main feature, rather than just the issue date, making it easier to find those articles most helpful to you. (Note: Because we are happy and proud about our new design, we are running this entire article on the home page.)

Reviews You Can Use

Many of the nearly 2,000 articles we have posted here over our first seven years provide objective reviews of golf communities in the southern U.S. With the new Golf Community Reviews, we present a list of the most often read reviews up front on the home page, as well as archived articles listed by state. If you are looking for information on golf communities in, say, South Carolina, our new site will speed the process.

New, More Helpful Links

The redesign has focused us on the need to provide quick access to other sites of interest to our target audience, loosely defined as baby boomers and pre-baby boomers who play golf and are looking toward a meaningful retirement in a climate with virtually year-round golf. These links will be real estate related, golf related and lifestyle related, and they will only be those that, in our opinion, are most helpful. If you have a favorite site that others would appreciate, please let us know. (Contact us.) Also, we are attaching to our articles icons that connect to the most popular social media sites, making it simple for you to quickly share any articles you like on our site with your friends and family.

Your Search for a Golf Home Made Easier, Friendlier

Although dozens of our customers over recent months happily filled out our proprietary Golf Home Questionnaire (click here for access), we will be refining it in the coming weeks, adding a few categories of questions and deleting others that have not been relevant (e.g. most people don’t know whether they intend to get involved in club governance). We are learning a lot from our customers’ feedback on specific golf communities they visit, and we intend to share their comments with others searching for a golf home.

Instant Golf Home Gratification

If after reading one of our golf community reviews, you are favorably disposed to the community, your logical next question is probably, “What are the homes like…and can I afford them.” Our companion web site, GolfHomesListed, makes it easy to figure that out. With our new site design, we have gone back to look at published reviews to ensure they include a link to current golf homes for sale in that community. (If we do not list homes for sale in a community of interest to you, just contact us and we will be sure to get you a few sample listings.)

Home of the Week

Beginning with the debut of our new design, each week we will feature prominently on our home page one current property for sale in a golf community we have visited and can recommend. It may not be the least expensive home available, or the most expensive, but in the opinion of those real estate pros we work closely with, it will represent an extreme value.

Can We Get a Witness? Yes.

Many people rely on a friend or relative to recommend a real estate agent; we don’t have a relative in the business but we do have satisfied customers we have helped to find their dream golf homes in the southern U.S. And they are happy to share their experiences with our audience. Look for some of those testimonials at our new Golf Community Reviews.

Picture this

The software that drives our new site provides added flexibility to install additional user-friendly options. One of those is a photo gallery. On any given golf course, I take a few dozen photos for every one we post. To provide an even better sense of golf course layouts and design, we’ll be adding thumbnail photos along with the larger ones we post, giving you an opportunity to see more photos in one place on our site. And we intend to add scorecards from the courses we play as well. Stay tuned.

When I push the furniture around at home, sometimes my wife likes it and sometimes she doesn’t. If there are any aspects of the new web site design you do not like, please let us know and we will gratefully consider your input. The new Golf Community Reviews is designed to make it easier for you to navigate the site, find what you are looking for and make your search for your dream golf home easier. Please help us accomplish that.

Southeast well-represented in Top 100 golf community course rankings from Golfweek magazine

Big jumps for Currahee, Spring Island,

Cliffs at Keowee Vineyard and Daniel Island

It was a very good year for golf courses in communities we follow closely. A total of 35 golf community courses made Golfweek magazine’s Top 100 Residential Golf Courses for 2014. Wade Hampton, the exclusive club near Cashiers, NC, weighed in at number one overall. Another Cashiers area golf community layout, Tom Fazio’s Mountaintop course, came in at an impressive 12th position.

We were pleased to see that Cuscowilla, the Coore & Crenshaw understated design achievement in Eatonton, GA, just crept into the top 20. If you like classic designs on a walkable layout, you’ll love Cuscowilla. Better yet, if you are in the market for a golf home, you can pair a trip to Cuscowilla with a stop at Reynolds Plantation, where its Nicklaus-designed Great Waters course on Lake Oconee holds down the 71st position on Golfweek’s elite list, a whopping improvement of 21 places since the 2012 list was published. Reynolds, which boasts six excellent layouts, is now two years into ownership by MetLife, and we look for additional improvements as the months roll on. (Click here for golf homes currently for sale at Reynolds Plantation.)

Jim Engh's Creek Club course at Reynolds Plantation might have missed the top 100 list because it isn't walker friendly and it is easier than it looks.

Jim Engh's Creek Club course at Reynolds Plantation might have missed the top 100 list because it isn't walker friendly and it is easier than it looks.

We were a little surprised, though, that Jim Engh’s iconic Creek Club layout at Reynolds did not make the top 100 list. The unusual, somewhat odd layout is beautifully sculpted with distinctive red-tinged bunkers and meandering streams throughout and, according to the golf pro there, is way easier than it appears. Mindful that Golfweek puts a strong emphasis on shot-making challenges, the fact that most sloping at Creek Club tilts toward the holes, even on a few funneled greens, could explain Creek Club’s absence from the list.

The $200,000 Question: What kind of 3 bedroom golf community home can you find at that price?

A few days ago, I received a request for help in finding a golf home for a couple from Michigan. They filled out our Golf Home Questionnaire and indicated the following criteria for their search: Inland location, 4 BRs, 3 BAs, public golf course okay, pool and fitness center, $200,000 ceiling. As I did the initial research for them, I was surprised to find just how many high-quality golf communities feature homes for around $200,000, although as I wrote the couple, they may have to modify their requirement from four bedrooms to three in order to find the widest selection.

Here’s a brief summary of a few golf communities where we found single-family homes of at least three bedrooms listed at $200,000 and lower.

Cedar Creek, Aiken, SC

This is an established community with a public golf course designed by Arthur Hills, one of my favorite golf architects. Aiken is a charming southern town favored by equestrians and, more and more, retired golf enthusiasts. The $200,000 price tag is at the very bottom of the price range in the community, but we noticed one listing for $199,900 with pretty much everything but a fourth bedroom. Contact me if you would like more information or a referral to our trusted real estate associate at Cedar Creek.

The two 18 hole layouts at Savannah Lakes Village offer a contrast in design. The Monticello course -- the approach to the 2nd hole shown here -- features gentle contours and a challenge to shotmakers. The Tara course is much hillier.

Savannah Lakes Village, McCormick, SC

Because it is fairly remote – Augusta, GA, is the nearest town of consequence, and it is almost an hour away -- Savannah Lakes real estate prices are as sharp as anywhere, especially given its location on the large man-made Lake Thurmond and its two excellent golf courses, as well as an interesting municipal park golf course across the street at Hickory Knob State Park. Savannah Lakes is big enough to provide virtually everything you need in the way of social activities, but you will have to use your car for things like groceries, doctors' appointments and restaurants. I saw a few listings for 4 BR homes here, but the real "value" appears to be in the plentiful selection of 3 BR properties under $200,000. I’d be happy to share more information. (Contact me.)